Big Data and the Fashion Industry

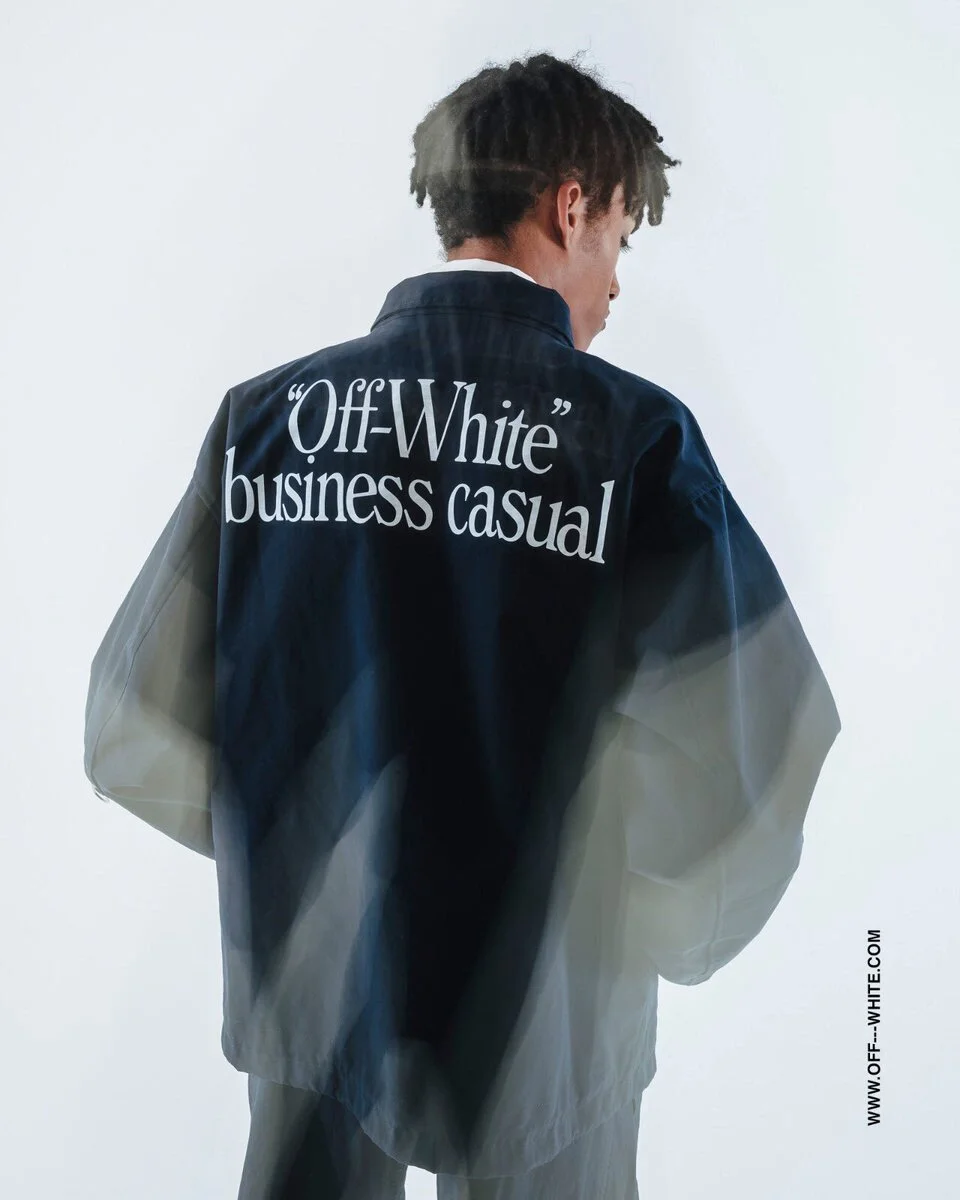

fw18 men’s Off-White “Business Casual”

Recently, I started working on creative design and direction as the Creative Director of my friend’s new clothing brand, AILI. Starting any business comes challenges, especially in an industry as saturated as the fashion industry. Not only do designers compete to be the most innovative, but they also compete against the large-scale counterfeit markets and fast-fashion companies. Our big challenge as a new brand is to create a unique, high-end look while providing price-conscious accessibility for our target audience: young, artistic consumers. My first contributions to AILI were grounded in research and data, to emulate patterns of successful businesses. My INFO 201 Technical Foundations course, which focuses on data and R got me interested in how big data is used in this fashion industry and how to use it effectively.

With access to big data collected in real time, many corporations in the fashion sector are capitalizing on data trends and analytics to understand their consumers better. The process of data analytics in this industry is fascinating.

According to this article [The Need for Speed Capturing Today’s Fashion Consumer], the big data on consumers comes from:

· Search data: what topics are trending on search engines and who is searching for them

· Social media: the range of styles and colors that are trending

· Competitor scans: what attributes and prices do competing successful products have

· Product ratings: from the merchant’s site or retailer’s sites.

Big data is essential to the fashion industry, as it relies on agility to constantly produce the most profitable clothing trends in the market. As trends change quickly, data scientists can track profitability and quickly determine when customers are interested in a product.

Companies like Zara tailor their products by region and produce new products around every two weeks, depending on popularity. Big data can help clothing companies by creating subsets for who’s interested in certain products based on the following factors:

· Region: Different regions have different trends and some follow each other. For example, many American fashion trends originate in Europe or Australia.

· Gender: Which gender(s) should a clothing company tailor to? Who is interested?

· Body Size / Build: This can aid companies with investing in more products of certain sizes, depending on popularity.

· Socioeconomic Status: Who’s buying the products? Who can afford these products? If most consumers are in a higher / lower socioeconomic class, how can we adjust pricing for profit?

Finding out these patterns through data visualization is key to success in today’s competitive industry. Data doesn’t lie, and with our limited budget, creating data visualizations helped me decide how to create a plan for AILI moving forward. One trend we’ve latched onto is the popularity of limited-edition trends and customized drops seen in the streetwear industry with Off-White / Nike, among other brands.

Despite the relatively expensive prices of these products, many teens and young adults of a variety of nationalities and genders (many of whom presumably work minimum wage jobs based on age) sign up for a raffle system through the brands to buy these products, and these products are sold for even higher on the resale market. The luxury of having a unique product in such a saturated industry is the driver for consumers. Emulating this, we’ve decided to cut down the quantity of our products as well. This effectively saves our budget while elevating the demand for our custom cut and sewn products that are exclusive in theory to our first buyers.

It’s not enough to merely create anymore; the data is always changing, and we should give it our attention.